Conventional Clichés

—On the virtue of being independent—

Keynes wrote, “Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally.” Pure genius: in 16 words he managed to describe a key constituent of human nature and an entire industry. If the red fish hits the clean bowl he will be just fine; if he misses he’s dead.

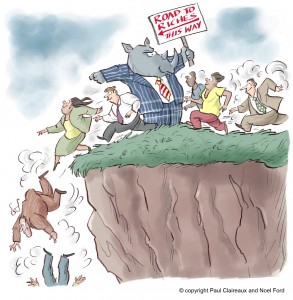

Humans are social animals. They don’t like loneliness and find it difficult to go against popularly held views. In science it sometimes takes years or decades to accept new concepts and discoveries; innovators absorb an extraordinary amount of personal and professional risk. In financial markets one of the consequences is encapsulated in a phrase often repeated to me by a former boss: “Markets always go where they cause more pain.” Her words rhymed with Keynes’: markets will move against large and popular positions because unexpected events have more impact in such cases, and because there must be few new potential buyers left. Urban folklore has it that a taxi driver giving you stock tips is never a good sign.

The American Association of Individual Investors (AAII) publishes a weekly survey of its members with a simple bullish-neutral-bearish tally. In this spreadsheet (aaii sentiment 2015 0423), under the tab “Chart”, you will find a graph with the evolution from 1987 of the S&P 500 and of the bullish sentiment in the AAII survey. You can’t “read” every zig or zag of the weekly survey because it’s too volatile, but you can see the aggregation of sentiment over longer periods. Broadly speaking, the graph shows periods of rising markets associated with higher levels of bullishness, declining markets going together with decreasing bullishness and notable market tops or bottoms happening very near excessive or depressed optimism. A more thorough analysis of the predictive power, if any, of the AAII survey was done in June 2014 and you can find it here.

How much can crowd behavior cost? The short answer is “a lot.” We know most investors stink at market timing by entering and exiting close to market extremes, frittering away about ½ of market returns. John Bogle, founder and former CEO of The Vanguard Group, has written a number of pieces on the subject as have many others. Peter Lynch, former legendary manager of the Magellan Fund, put it this way: ”Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.” Last week John Authers did a good job in an FT article with the somewhat misleading title “Investor Returns Are All About the Timing.” (Hopeless optimists beware: the article is not a recipe for making money but provides clues for avoiding wasting it.)

There is value in old clichés after all: being in “good company” when you invest can end up hurting you. Investing is a job for the daring and informed loners who can carefully pick among the many opportunities to go against the grain.

Photo sources: curatti.com; irateinvestment.com; projectm-online.com middletownbiblechurch.org.