THE SHOTGUN APPROACH TO INVESTING

Exactly how not to think when investing your money.

“Did he really say that?”

“Yes.”

“Are you sure?”

“Yes.”

My colleague (not the same I recently posted about) and I stared at each other. Our boss had just uttered one of his maxims. He was a short, wiry, bespectacled man, with an unreadable smile constantly plastered on his face, an air of superiority and a well-concealed peculiar way of thinking. “Remember this,” the boss said, “every day there is some security or market that goes up.” Then he walked to his office, muttering “That’s how you make your clients happy.” The unspoken words were “by predicting what those securities and markets are and investing in them.”

“Did he mean every day there is a red car that passes by some street somewhere in the world?”

“I think so.”

“Or every day someone dies and/or someone else is born?”

“Or every day a tennis ball is hit somewhere.”

“That’s a good one! How’s this: every day someone makes a doughnut without a hole somewhere.”

“That’s weird.”

We debated what he meant; after all he was our boss and if we did not act upon his visionary thinking we had better come up with an alternative. I was younger then; had I been the age I am now the alternative would have been clear: call the closest psychiatric hospital. We reasoned that his point had certain merits as he was actually telling the truth and you never dismiss the truth out of hand: every day there is some security or market that goes up. We also concluded the corollary of the statement was “every day there is some security or market that goes down.” We felt oddly heartened by the brilliance of our reasoning.

“What’s the name of that super-computer maker? Can we fit one in the budget?”

“You mean Cray Research or Fujitsu or IBM? Fit one in our budget? Not even in a thousand years.”

We worked for a fairly small independent investment advisor and, despite the standard outsized fees, there was no way we could afford or house a super-computer.

“Why would you want one of those things anyway?”

“To scan the world for all the securities and markets, so that we know what goes up without failure.”

“And then what? If we don’t know that before it happens what use is it to us?”

“You are right; we need to scan after we figured out how to predict the right candidates.”

“Good luck with that!”

We went on to other more practical tasks. Our fearless leader, having shared the contents of his superior mind with us poor midgets, had already moved on to other worthy speculations. We kept our jobs.

The real trouble is that so many people think that with the right research and the right means you can actually tell every day which security or market goes up (or down).

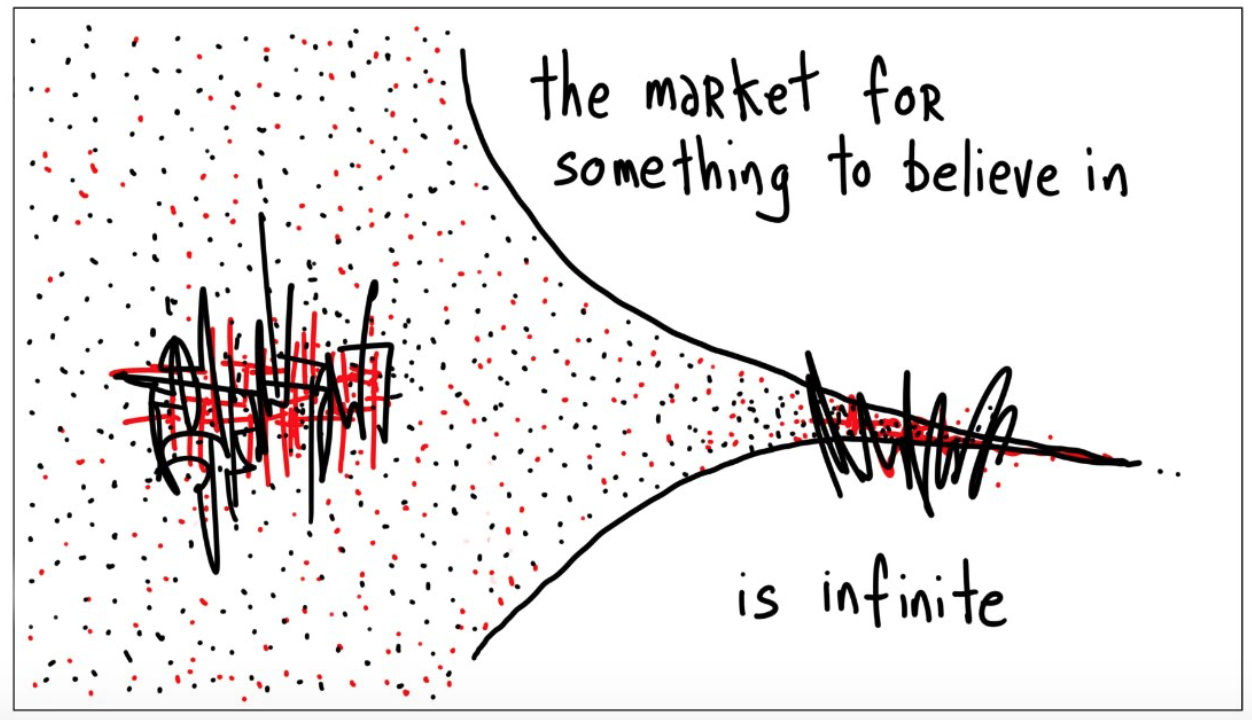

Photo sources: Hugh McLeod, http://gapingvoid.com; https://www.linkedin.com/pulse/20140421195822-1145551-the-market-for-something-to-believe-in-is-infinite