The Price of Friendship

The value of being called a butt-head early in your investing endeavors.

These days I rarely hear words of plain and direct talk with regards to an investment or an approach to investing. The interaction between “advisor” and client is mostly about deference, especially in countries where titles are of the essence (e.g., Italy), and cajoling into doing something for which the first ultimately gets paid. There is limited true honest debate and frank admission of what needs to be done and how.

Over time, clients are often lured into a false sense of security and trust with a string of “listen my friend”, “if I may say so, respectfully”, “I think you are right, but”, complemented with a generous amount of suitably exciting and varied entertainment, family talk, show of openness or intimacy and whatever is needed to get under his or her skin. So, while never truly knowing what is happening, clients potentially end up executing ideas and proposals which are most likely wrong (for their price or structure or their plain fundamentals) and getting hooked into a relationship which resembles genuine friendship but is more like a perverse form of scavenging.

The price of this well-orchestrated and craftily constructed ordeal? It all depends on three factors: the client’s willingness to listen to “professionals” who pose as “friends”, the size of the portfolio, the time horizon of the relationship. The weighted combination of these factors is crucial for an exact computation, but one can safely assert that in most circumstances the answer is A LOT.

It does not help of course that some clients purport to be looking for a service when they are vying for another – like the fellow who kept asking me for tickets to this or that event or for providing some training to one of his sons, and would compare the amount of such “service” with the one received from competing managers at every portfolio review.

Nor does it help that certain myths are kept alive and well by our natural willingness to like stories with good endings: “last year I made a quadrillion in pork belly futures”, “you should have bought Artificial Stupidity’s stock when I told you”, “remember: everyday something goes up, always” (this last one was regularly fed to wide-eyed clients by a “manager” I knew).

A disciplined understanding of what friends are for and what professional relationships ought to deliver is required for a sane administration of one’s wealth. Many years ago, when I was a portfolio manager for a large institution in New York, I used to buy and sell securities with a brilliant institutional salesperson. We would engage in arguments about the pros and cons of a trade idea, and she often used to push me in the right direction with a forceful “Listen to me, you butt-head!” I would listen, I would learn and have since remained immensely grateful to her for her honesty and straightforwardness.

We did become very good friends.

-Further Readings-

My Current Reads – a list of the last 30 items (books, articles or blog posts) I found interesting: right column on HOME page, or under LIBRARY –> MY CURRENT READS.

Research – economics and finance research papers: under LIBRARY –> RESEARCH.

-Photo Sources-

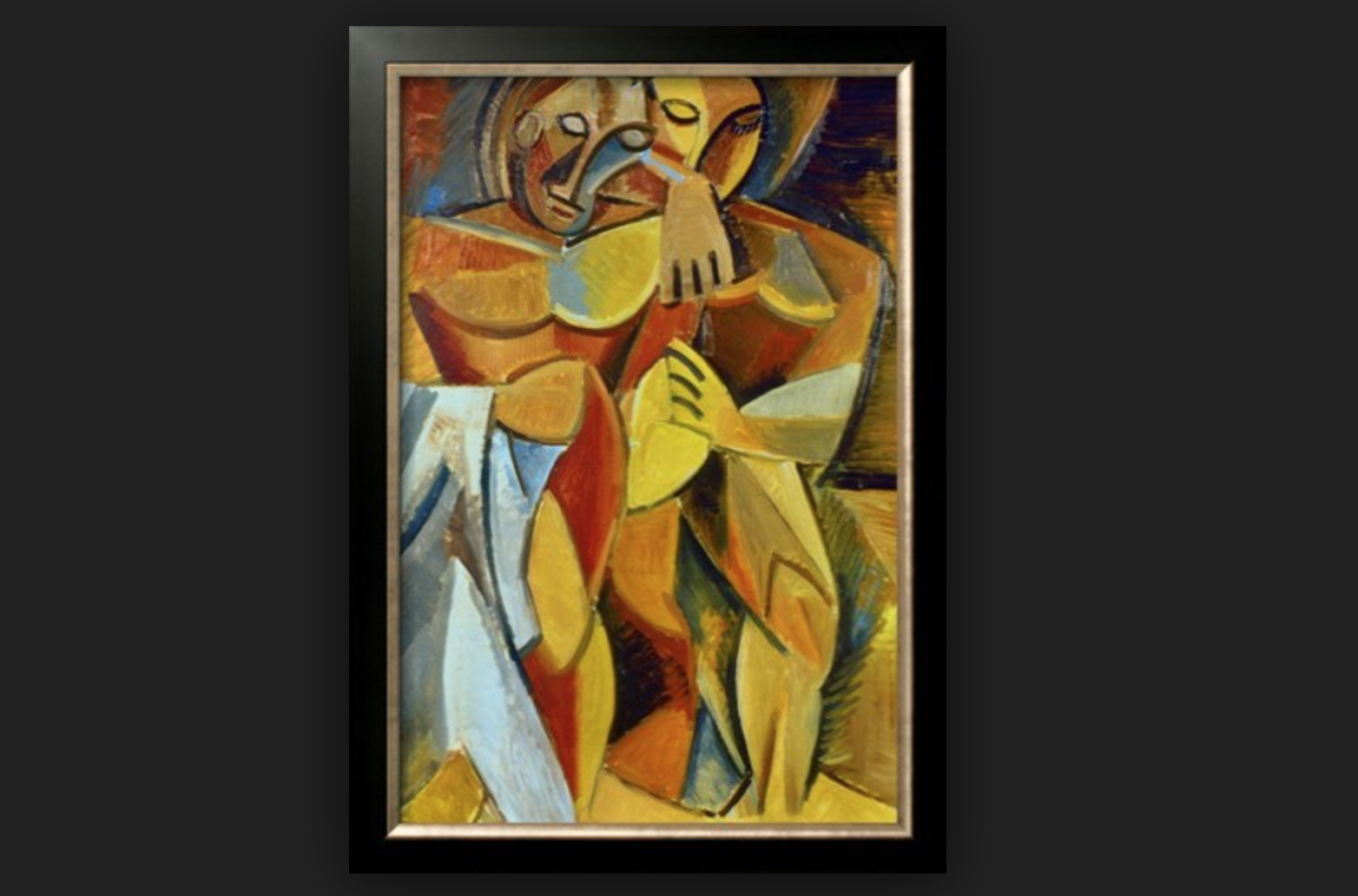

Cover: Pablo Picasso, “Friendship”, 1908; St. Petersburg, The State Hermitage Museum; http://www.pablo-ruiz-picasso.net/museums.php?museum=17