Focus on Control

Focusing on what you can control can lead to a better investment experience.

Whether you’ve been investing for decades or are just getting started, at some point on your investment journey, you’ll likely ask yourself some of the questions below. Trying to answer these questions may be intimidating, but know that you’re not alone. While this is not intended to be an exhaustive list, it will hopefully improve the odds of your investment success in the long run.

1. What sort of competition do I face as an investor?

The market is an effective information-processing machine. Millions of market participants buy and sell securities every day, and the real-time information they bring helps set prices. This means competition is stiff and trying to outguess market prices is difficult for anyone, even professional money managers. This is good news for investors though. Rather than basing an investment strategy on trying to find securities that are priced “incorrectly,” investors can instead rely on the information in market prices to help build their portfolios.

2. What are my chances of picking an investment fund that survives and outperforms?

Flip a coin and your odds of getting heads or tails are 50/50. Historically, the odds of selecting an investment fund that was still around 15 years later are about the same. Regarding outperformance, the odds are worse. Only 17% of US equity mutual funds and 18% of fixed income funds have survived and outperformed their benchmarks over the past 15 years.1

3. Do I have to outsmart the market to be a successful investor?

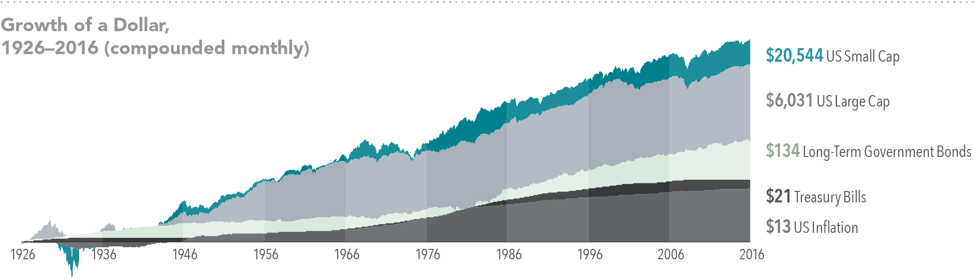

Financial markets have rewarded long-term investors. People expect a positive return on the capital they invest, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation. Instead of fighting markets, let them work for you.2

4. Will making frequent changes to my portfolio help me achieve investment success?

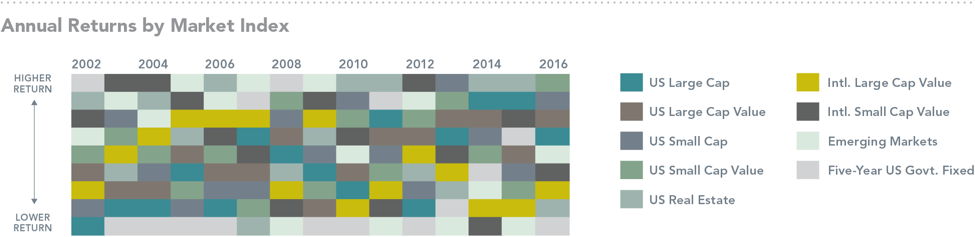

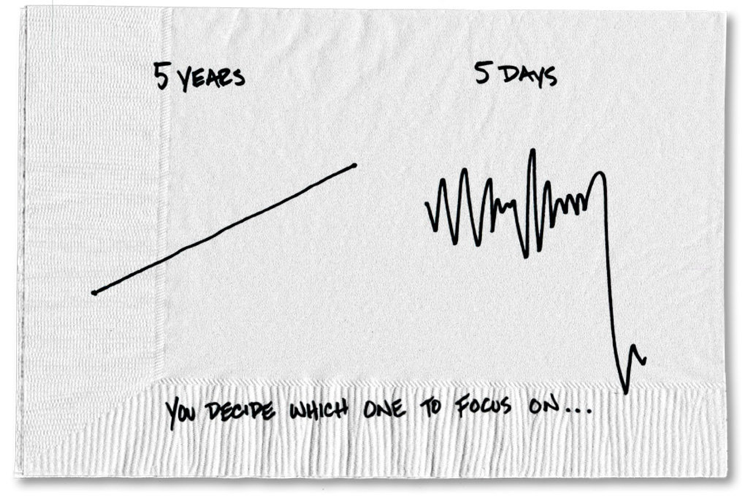

It’s tough, if not impossible, to know which market segments will outperform from period to period. Accordingly, it’s better to avoid market timing calls and other unnecessary changes that can be costly. Allowing emotions or opinions about short-term market conditions to impact long-term investment decisions can lead to disappointing results.3

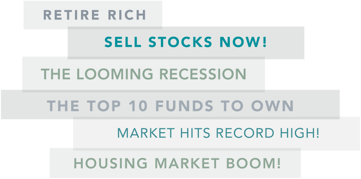

5. Should I make changes to my portfolio based on what I hear in the news?

Daily market news and commentary can challenge an investor’s discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. If headlines are unsettling, consider the source and try to maintain a long-term perspective.

6. So, what should I be doing?

Help guide yourself to a better investment experience by staying focused on what you can control and actions that add value. The rest is just noise.

– Create an investment plan to fit your needs and risk

– Structure a portfolio along the dimensions of expected returns

– Diversify

– Manage expenses, turnover, and

– Stay disciplined through market dips and swings

Michael Tanney

-Notes-

1 Source: Mutual Fund Landscape 2017, Dimensional Fund Advisors. See Appendix for important details on the study. Past performance is no guarantee of future results.

2 US Small Cap is the CRSP 6–10 Index. US Large Cap is the S&P 500 Index. Long-Term Government Bonds is the IA SBBI US LT Govt TR USD, provided by Ibbotson Associates via Morningstar Direct. Treasury Bills is the IA SBBI US 30 Day TBill TR USD, provided by Ibbotson Associates via Morningstar Direct. US Inflation is measured as changes in the US Consumer Price Index. US Consumer Price Index data is provided by the US Department of Labor Bureau of Labor Statistics. CRSP data is provided by the Center for Research in Security Prices, University of Chicago. The S&P data is provided by Standard & Poor’s Index Services Group. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results.

3 US Large Cap is the S&P 500 Index. US Large Cap Value is the Russell 1000 Value Index. US Small Cap is the Russell 2000 Index. US Small Cap Value is the Russell 2000 Value Index. US Real Estate is the Dow Jones US Select REIT Index. International Large Cap Value is the MSCI World ex USA Value Index (net dividends). International Small Cap Value is the MSCI World ex USA Small Cap Value Index (net dividends). Emerging Markets is the MSCI Emerging Markets Index (net dividends). Five-Year US Government Fixed is the Bloomberg Barclays US TIPS Index 1–5 Years. The S&P data is provided by Standard & Poor’s Index Services Group. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Dow Jones data provided by Dow Jones Indices. MSCI data ©MSCI 2017, all rights reserved. Bloomberg Barclays data provided by Bloomberg. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results.

-Further Readings-

Our Current Reads – a list of the last 30 items (books, articles or blog posts) we found interesting: the right column on the HOME page, or under LIBRARY > OUR CURRENT READS.

Research – economics and finance research papers: under LIBRARY > RESEARCH.

-Photo Sources-

Cover:https://static01.nyt.com/images/2016/06/27/business/062716bucks-carl-sketch/062716bucks-carl-sketch-master768.jpg

Excellent post, Mike! I enjoy hearing and discussing your insights on the market, and so happy to see the success of Wanderlust. Looking forward to a great and prosperous 2018!

Thank you! Happy and healthy 2018 to you too.

good post

Thank you!

Thank you for the excellent post

Thank you for the kind feedback. We hope you find all of our blog entries helpful!

This is really helpful, thanks.