This Time Is Different

by Morgan Frank, Portfolio Manager, Manchester Explorer Fund

The year is 2019. Pets still cannot drive. Once more, a bubble in “new economy” stocks rages yet, amazingly, the poster children have not changed. Julie Wainwright, former CEO of dot-boom flameout avatar “pets.com”, who had the helm during the 268 day period between the IPO and the literal cessation of operations (perhaps the fastest IPO to BK sprint in large cap history that, if memory serves, included a Superbowl ad) is back and the debut of her new business “The RealReal” (NSDQ: REAL) which IPO’d on Friday looks poised to once more signify for good and all that the final vestiges of sense have left the building. While she is far from the only such case, the irony piled upon irony here is simply too delicious to ignore. Not only is this the same Julie who socked it to the sock puppet fans, but her new venture, an “online marketplace for buying and selling authenticated used luxury brands” is a leader in the “circular economy.” If the phrase “circular economy” sounds a bit like “cash incinerating Ponzi scheme” to you, rest assured, you have company. It appears that Ms. Wainwright is looking to go 2 for 2 on being the perfect exemplar of the tech bubble. This is not even history rhyming. This is history slapping a new coat of paint on the same storefront and throwing a grand opening sale. Nothing at all has changed. RealReal is just pets.com on a larger financial scale in a nicheier market. (Yes, we know that is probably not a word.)

In 1999, pets.com spent $11.8 million in advertising. This seems paltry by today’s outlandish standards, but it was a princely sum at the time. This “investment” in creating possibly the most iconic puppet of all time not designed by someone named “Henson” yielded a somewhat less princely $619,000 in revenue for the year. Making this all the more impressive, they were losing money by selling products for roughly 1/3 of what it cost to acquire them. As one can imagine, shouting from the rooftops that one is selling dollars for 33 cents can drive quite a lot of new sales. As one can also imagine, this is not a good thing for one’s solvency. Sales rose, projected improvements in margins failed to materialize, and even at “scale” merchandise was sold at 27% below cost. Whoo doggie. They went public in February 2000, one month before the bubble burst. By November of that year, they had ceased operations entirely.

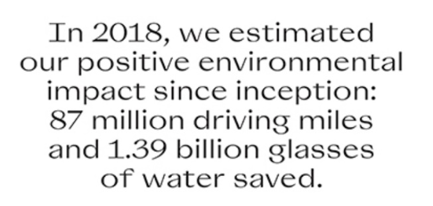

This brings is to the RealReal where a new line of flashy ads assures us that “The future of luxury is circular.” Like every one of these bubble babies, we’re supposed to look at nonstandard metrics and straight revenue growth while eschewing profits as an outmoded concept for those not seeking to dominate their space. Whereas in 2000 it was eyeballs, today, on the 4th page of the S-1, before such fusty old metrics as “sales” have even been mentioned, we get a trumpeting of environmental impact, the magic bullet of this bubble:

Leaving aside that this is basically nothing and utterly unsubstantiated in any real sense, this is NOT what you want to see a business lead with when assessing the likelihood of future profitability. In fact, in the entire 5-page blitz of glitzy ad reproductions and sales and customer stats that lead off the prospectus, the concept of profit or margins does not appear once. Pro tip: when a company or asset manager pivots to “saving the world” it is not a sign that profits are good.

Having learned from prior lessons, it appears that RealReal now has very strong gross margins, but are they, in fact, real gross margins? As you are selling someone else’s goods on consignment and just taking a cut, one might expect to see high margins, after all, you basically have no cost of goods sold. This is very much in evidence. But, persnickety fellows that we are, we are big fans of looking at drop through on profit to see if companies are getting traction or just spinning their wheels. Anyone can generate large sales growth if they are willing to sell dollars for 80c (or often far less). As we look at the most recent quarter, we certainly see revenue growth. $46.5mm in 3/2018 rises 49% to $69.3mm in 3/2019. On the gross profit line, we see $30.6mm rise 39% to $42.4mm. So, we see some margin compression, but they are still at 61%, nothing to sneeze at, though perhaps lower than one might expect given that the revenues reported are already net of payments to the consignor. Then, the trouble starts. What is deemed “marketing” rises to $11.7mm from $9.6mm. This is not bad and, in fact, is not even rising as fast as gross margin (though it is eerily similar to the pets.com 1999 spend, but now per Q not per year), but this is also Julie Wainwright, so this seems a bit off. She loves advertising and discounting. We then see a big rise in operations and technology and in the catch-all bucket of SGA. The net result is revenues up 22.7mm, gross profits up 11.7mm, and operating expense up 21.1mm. Opex rose nearly as much as revenues and nearly twice as much as gross profit. It is a common shell game to hide discounts, sales incentives, and a variety of transaction dependent costs in SGA. The telltale of this game is that no matter how much revenues and gross margins rise, operating losses keep widening. The story is that they are “investing for growth.” The reality is that they are losing money on every sale. This is pets.com all over again but more cleverly disguised, better funded (they raised $300mm vs $82mm at pets.com), and even more valuable. Julie has not lost her touch – nor, perhaps, her sense of timing.

“You need to lose money to make money” was not true in 1999 and it has not become true since. This story is always that we have to lose tons of money now and use to it get established and once we are, we can make lots of money. Amazon is trotted out as the exemplar of having done this. Amazon never did this and the bizarre article of faith that they did is one of the great, longstanding myths in the equity market. It simply did not happen. Amazon was cash flow positive from operations in 1997 and in 1998 having lost a mere $2mm from ops in 1996. In 1996, they had $15.7mm in revenues and in 1997 they had $148mm rising to $610mm in 1998. They did that while flowing cash from ops. These are the simple facts. They are the classic example of a company running at an even keel from ops and growing like crazy. They have had positive free cash flow in all but 2 years of their operations, their first, and 1999. This idea that Amazon ran huge losses to get share then turned that share into profits is a boat anchor routinely mistaken for a spinnaker. This is NOT a path to success. It pretty much never works. If you do not have scale at $200mm in revs in online retail, scale is probably not coming. This “lose money to grab land” paradigm is the Bermuda triangle of business models.

It’s also the clear crowd favorite at the moment as every firm from Uber to beyond Meat to Chewy (owned by PetSmart, who bought the pets.com domain which redirects to their site to this day) is running this same playbook. This is how one spots the cliff coming. 95% of these firms will be gone in 5 years. They will not make the turn to profit. This is investing stood upon its head where cash incineration ability generates market cap. Having watched this from front row seats in the 2000 bubble as, if not wet then at least slightly damp behind the ears young analysts, we recall remembering what a joke we thought it all was, but, it was also OUR joke. We were dead in the middle of the zeitgeist of that market and happy to dance along so long as the music looked like it would play and smirking at the “oldsters” who saw it as too absurd to touch. Time is a funny thing and has a way of sneaking in role reversals where you least expect them. Today, we find ourselves in the role of the oldsters pulling our pants up to our chests and yelling at the kids to get off our lawn. We just see no rational way to play this from the long side. At the same time, we see it sucking all the air out of everything else, especially small and micro caps and small and micro cap biotech most of all.

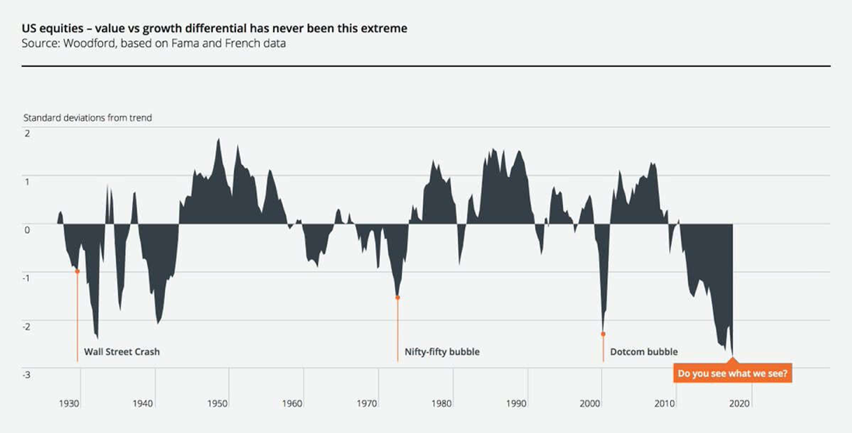

This continues to make for tough sledding for us as the slush in our space seems ever thicker and slushier. But, unlike many who threw in the towel in 2000 claiming markets just do not make sense anymore, we have seen just this sort of carnival misrule before and learned that they key to riding it out is to keep doing your thing and ignore all the short term travails and temptations. Calling the top on this sort of tape is notoriously impossible, but there are signs to look for and so, in the face of the odds and of general common sense, here is what we suspect: this bull market is coming into end times. Sure, the world is awash in cash from loose central bank policy, but these deals are huge and the valuations immense. They suck up capital like California almond groves suck up water. They are coming public after far more VC funding and with far larger raises. Add to this that the US and global economies all look wobbly and our belief that the US China trade war will not be averted and the peril here looks quite real and quite imminent. Take this with a grain of salt as the chances that we are about to join the storied ranks of those who have predicted 18 of the last 2 bear markets are quite good, but the overall situation looks conspicuously fraught to us and a huge monthly run up in US markets based pretty much entirely on a belief that the plunge protection team is back at the Fed and will cut rates to hold up the markets has done anything but reassure us. The forthcoming descent into political farce for this election and the possible regulation or breakup of US internet titans who just keep stepping on every rake on every lawn from Washington DC to Brussels add further risk. Threading this needle through to daylight would be no mean feat and the current disconnect is now rising to levels exceeding even 2000.

Value is so out of favor that, like the cousin you see at reunions once a decade, it’s hard to remember what it even looks like. This has flowed through into micro caps, which have massively underperformed as well as to lots of traditional industries. Just as in 1999, these are viewed as “fossils.” And who would want to bank one or cover one? They are no fun and they are not even remotely profitable for Wall Street in comparison to the top fuel drag racers of cash incineration like Uber and Lyft. Who do you want as a banking client? A profitable trucking fleet or a breakneck ride sharing co that needs to raise $2bn a year just to keep from dying? But this cycle does end, and it ends because the geometric rise in the amount of capital needed to sustain it doubles one too many times. Then, Icarus falls. REAL rallied 45% from IPO price on its debut valuing the company at $1.7bn. That’s half of what AMZN was worth in 2001, a year AMZN did $3.1bn in revenues and, despite the dotcom crash and recession, had $73mm in FCF. REAL has 95% less revenue, loses money, and is growing much more slowly than early Amazon while addressing a market that is not a rounding error in comparison. This is true of most of the current crop of unicorns. They seem to need orders of magnitude more capital to survive. We suspect that, like the candle that burns brightest, they shall also shed their light but briefly.

Morgan Frank, July 2, 2019

Cover: René Magritte, ‘The Treachery of Images’, 1929; https://collections.lacma.org/node/239578