Cash

Certain advisors’ practice to exclude cash from their fee calculation is wrong.

*****

Clients will often find, within the elaborate and arcane details of management fee calculations, the appealing clarification that any liquidity held in the account will be excluded. This may feel fair and square, but in this case it is no. You should know by now that rare is the instance which finds me on the side of charging the client “more.” Here in reality we are dealing with a simple misinterpretation supported in part by advisors’ fear of losing business.

I should clarify I’m talking about cash or liquidity managers and advisors have elected to keep in the portfolios delegated to them, where this delegation allows for such election. If clients decide to keep cash in their accounts, for whatever reason, then it should not be included for fee calculation purposes – but in this case it logically would not be part of the advisory mandate. In cases where it is allowed, an active allocation to cash is a portfolio allocation decision like any other: going long European versus US stocks; selling 10-year bonds to buy 2-year securities; whatever. In these circumstances cash is part of what the advisor is paid to supervise; forcing a conflict of interest – between business needs and client’s welfare – by excluding cash from his compensation is nonsense.

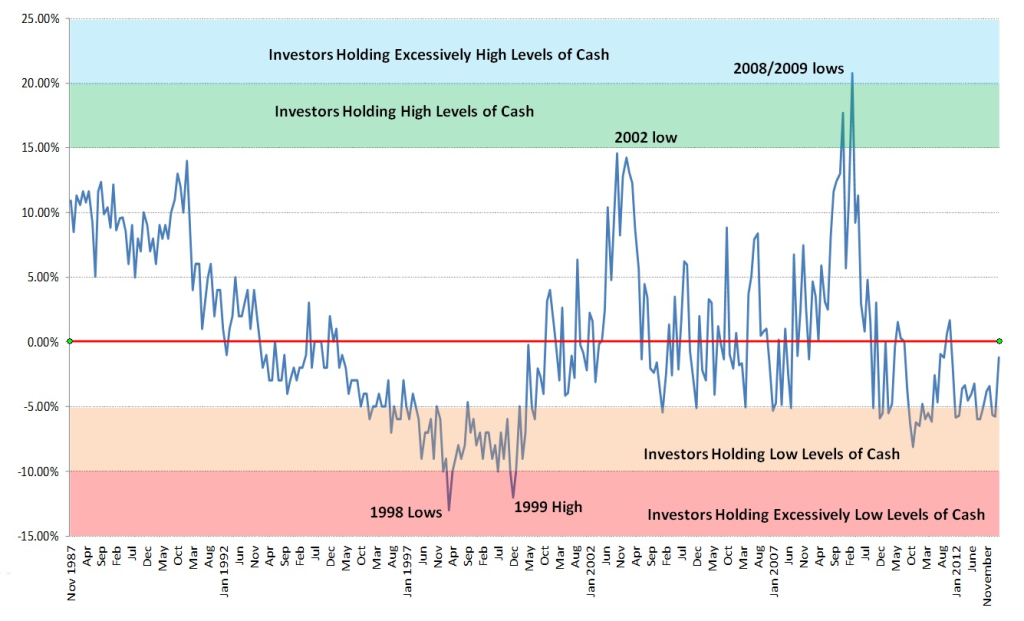

Often the justification for the cash exclusion includes misconceived ideas such as “paying advisors for ‘investing’, not sitting in cash”, or the fact that cash today pays 0 and so advisor’s fees are even more taxing. These excuses are plain silly: just think of the example where again today 20-30% of government bond markets trade below 0% yield; should all allocations to them be exempted from fees? Furthermore, such ideas will hamper the task of the manager, who in many cases will be targeting to generate smoother returns over a cycle. Cash is or can be a part of this process. View it, if it helps, as an insurance policy: the client’s shortfall in yield or return relative to other investment alternatives is a “premium” to protect the portfolio from expected losses. Ex post the decision to hold cash can still be right or wrong, but the ex ante underlying concept does not change.

What is one to make of advisors who abide by the practice of exclusion? From the above reasoning it should be clear this is not an issue of fairness. It is an issue of coherence and perhaps even integrity, an issue which should make us wonder where the fee shortfall will inevitably be recovered.

Photo source: www.ritholtz.com