Back to School

by Michael Tanney (*)

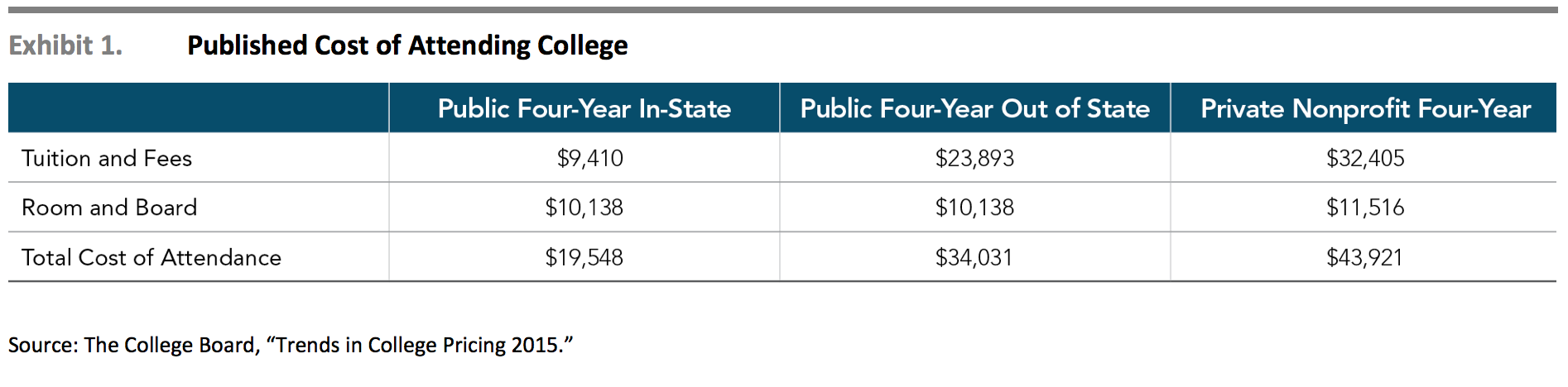

With freshman heading off to college later this month, many parents are likely thinking about how best to prepare for their children’s future college expenses. According to recent data published by The College Board, the annual cost of attending college in 2015–2016 averaged $19,548 at public schools, plus an additional $14,483 if one is attending from out of state. At private schools, tuition and fees averaged $43,921.

To help reduce the costs of funding future college expenses, parents can invest in assets that are expected to grow at a rate of return that outpaces inflation. Therefore, college costs may be funded with fewer dollars saved now. Because these higher rates of return come with the risk of loss, this approach should make use of a robust risk management framework. Through a tax-deferred savings vehicle (a 529 plan), parents may avoid paying taxes on the growth of their savings, lowering the cost of funding future college expenses.

While inflation has averaged ~4% annually over the past 50 years, stocks (as measured by the S&P 500) have returned over 9% annually during the same period. Therefore, the “real” (inflation-adjusted) growth rate for stocks has been ~5% per year. We can expect the real rate of return on stocks to grow the purchasing power of an investor’s savings over time. We can also expect that the longer the horizon, the greater the expected growth. By investing in stocks before a student reaches nursery school, parents can expect to afford more college expenses with fewer savings.

It is important to recognize that stocks come with investment risks. Like teenage students, investing can be volatile, full of surprises, and expensive. While easy to forget during periods of increased uncertainty, volatility is a normal part of investing. Tuning out short-term noise is difficult, but historically, investors who have maintained a disciplined approach have been rewarded.

Working with an advisor who has a transparent approach based on sound investment principles, consistency and trust can help identify an appropriate risk management strategy. This approach can limit unpleasant (costly) surprises and contribute to better investment outcomes. An essential part of maintaining this discipline is establishing a well-defined investment goal. As a student gets closer to college age, the right balance of assets will shift from high expected return growth assets to risk management assets.

Diversification is also a key component of an overall risk management strategy. By diversifying an investment portfolio, parents can help reduce the impact of any one company or market segment negatively affecting their ability to fund college. Diversification helps take the guesswork out of investing.

Higher education may come with a higher price tag, so it makes sense to plan in advance. There are many unknowns involved in education planning, and there is no “one size fits all” method to solving the problem. By having a disciplined approach toward saving and investing, however, parents can remove some of the uncertainty from the process.

-Note-

(*) Michael Tanney is the Co-Founder and Managing Partner of Wanderlust Wealth Management, an independent registered investment advisory firm headquartered in New York City. Outside of finance, he has a passion for experiencing culture through travel and expanding his culinary palate.

-Further Readings-

My Current Reads – a list of the last 30 items (books, articles or blog posts) I found interesting: right column on HOME page, or under LIBRARY > MY CURRENT READS.

Research – economics and finance research papers: under LIBRARY > RESEARCH.

-Photo Sources-

Cover: http://screencrush.com/files/2013/09/Back-to-School.jpg

write my college essay for me http://dekrtyuijg.com/

Reliable advice. Regards!

We are happy to never write a college admission letter again! Thank you for the kind words. We hope you find the other entries on our blog reliable advice too.