Today’s World

When someone does it better than you, don’t waste your time: from the March 2016 Investor Letter of the Manchester Explorer Fund, L.P.

Ordinarily I would just attach a file with the pertinent content, but in this case I’m lifting the relevant portions of the letter in order to abide by jurisdictional and regulatory restrictions. This is why this post violates my 500-word limit (for the first time).

In March, the broader markets were generally focused on Central Banks and monetary policy. All over the world, monetary authorities are once more becoming loquacious and active. A number of people have asked us what we think of the current policies and what they portend for the markets and the global economy. Our general take on the current central bank policies could probably be put most succinctly as “It’s like watching a precocious child try to fix a carburetor by driving nails into it with a wrench.” While this may not be particularly charitable, we fear it’s surprisingly apt. Economic issues that are rooted in regulatory overreach, demographics, legal and tax policy, and neo-mercantilism are all being treated as if they are monetary issues. They aren’t. It has become politically expedient to elevate central bankers to demi-god status and ascribe to them mythical powers to make economies run. They do not nor have they ever had such powers. The last 16 or so years has seen a wild and dangerous experiment in activist monetary policy. It is not a coincidence that this period has also (as we laid out last month) coincided with extremely weak growth in the developed world. Loose money and endless QE cannot drive real growth and such policies become logarithmically less effective as you near the zero bound. A project that does not make sense at a 10% cost of capital might make sense at 3%. That move in rates could have some plausible effect. However, a project that does not make sense at 3% still does not make sense at 1%. The only thing that such a rate move really affects are levered financial instruments. No one who cannot find a case to build a manufacturing plant at 3% is going to find one that works at 1%. The simple fact of the matter is this: you can inflate asset market prices with loose money, but you cannot generate real growth. It all looks very dramatic. If you do not really know how to fix a carburetor, our would-be mechanic looks quite purposeful and busy, but if you do and watch closely, you rapidly get very concerned about what is going on. The difficulty is that this policy is a huge political winner. It looks like politicians are doing something, it draws attention to bankers and away from the real issues, and it creates a sort of universal scapegoat who is not up for election and therefore can weather poor results by repeatedly claiming “it would have been much worse if we were not doing this.” No one in government really has any incentive to say “should we really be letting the kids do this?”

The EU just doubled down on this strategy. They cut rates to zero and deposit rates to negative 0.4%. Even more aggressively, they cranked up QE to EUR 80 bn a month and added high grade corporate bonds to the buy list. Predictably, markets roared on this, but the effect on the economies is likely to be negative. The ECB is also literally paying banks to take loans of up to 4 years. This too is going nowhere in terms of economic stimulation. The issues in the EU are not cost of capital based. They are rooted in over taxation, over regulation, excessive state intervention in markets, demographics, and debt loads. Politically expedient though it may be, as a solution, throwing more money at this malaise is not going to be effective.

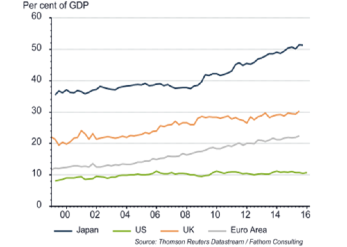

The chart above shows the cash on corporate balance sheets as a percentage of GDP. As can be readily seen, the numbers in the EU already high and have been rising for a decade. How anyone could look at this chart and conclude “What we need is more money for companies to invest!” is simply beyond us. If 22% of GDP is not enough, it’s difficult to envision what possibly could be. The flip side of “let’s make holding cash so unattractive that companies HAVE to invest” does not work either. Decades of trying this have gotten Japan nowhere but deeper into trouble. Decades of zero return on cash have just led to bigger and bigger cash piles. This cash hoarding is a symptom of the basic economies being moribund and unattractive for investment. Until you fix that and make investment attractive, no plausible punitive rate is going to tip the scales. Yet this policy is running rampant all over the world. The Swiss, the Swedes, and the Japanese are all committed to NIRP (negative interest rate policy). If this policy worked, wouldn’t one think it would be driving strong economic growth SOMEWHERE? Yet it’s not. It’s as though the whole world has become immune to evidence. Even the Fed, currently the sanest patient in the asylum, has backed off its rate hike plans. Meanwhile, the global debt markets remain wildly distorted. In the developed world, $26 trillion of government debt trades at below 1% yield and over $7 trillion at negative yields. That is a staggering number and it’s having knock on effects into every asset market in the world, but it still cannot drive real growth. Neither can big government spending programs that crowd out more than they add. What we need is a good, old fashioned Austrian economics style correction where malinvestment is purged and the economy is stimulated from the bottom up (through less regulation, lower taxes, and freer trade). What we are getting is a firehose of money aimed at economies that are already glutted with it. Money, like water, is dose dependent. You need some, but too much is deadly.

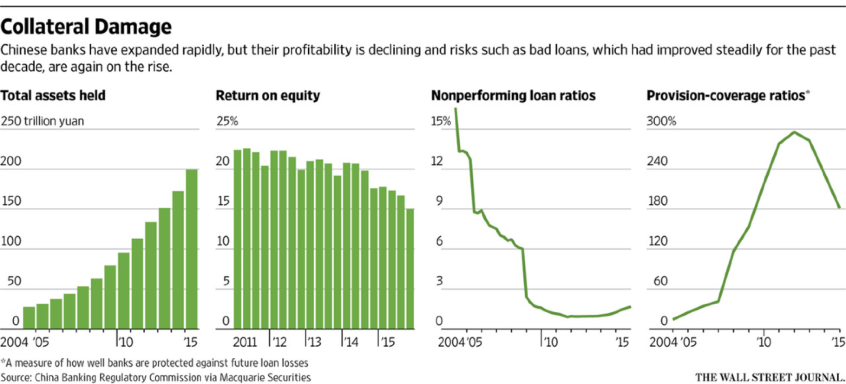

As ever, the worst of the lot appears to be China. They are deep into the death spiral of lending money to failing enterprises to help them pay off old debt. That sort of Ponzi lending does not end well. Bank assets are exploding. Coverage ratios (pretax income + loan loss provisions / net charge offs) are plummeting and are far worse in reality than reported. Corporate debt is now 160% of GDP in China up from 98% in 2008. The state is pushing banks to take big equity stakes in non financial firms as debt payment. This is how one winds up with a zombified Keiretsu system. That sort of mess could take decades to unwind.

So, all in all, we are back to the sort of distorted world where asset prices are not terribly tied to economic performance that characterized much of last year. March saw a big surge in the indexes that seemed heavily based in the futures and the ETF’s. It did not spread to the small caps, though they are beginning to show some signs of life in the last few days. Any space that needed to raise money was particularly excluded from the rally. We suspect we are finally seeing the bottom in micro cap biotech. We have been taking a bit of a portfolio approach and building small positions in a number of companies we like and that we know to be funded for 18-24 months. They have been sold off in lockstep with the guys gasping for funds and we think this lack of differentiation in trading provides an opportunity, particularly as several have good news already announced that has not really affected stock prices.

I couldn’t agree more.

Photo Source: http://dilbert.com/search_results?month=12&page=2&sort=date_desc&year=2011