This Is Close to My Heart

Akademia Investments: a clever way to help European foundations in their investment needs.

Recently Dorothea and I were watching a funny BBC show during which we learned there is a Bottleship magazine, published by The European Association of Ships in Bottles. I hesitated, but she was categorical: “No way.” Enter Google; it turns out that for GBP 18/year (for the UK; GBP 24 for Overseas) you can get four issue of this beauty; subscriptions welcome here.

My first reaction when I heard about Akademia Investments (http://akademia-investments.org) from my old colleague Benoit Mercereau, the co-founder and CIO, was the same incredulity displayed by my wife in the Bottleship affair, because I find it very difficult these days to get excited and motivated by a new venture in asset management. Akademia did the trick.

Most of you know that I come from a very particular angle when assisting clients in portfolio management questions. My approach is based on two basic premises: first, control costs (so that clients keep more of their money); second, control the clients (so that they don’t do harm to themselves). From the first of these premises it’s easy to jump to the conclusion I am nothing but another run-of-the-mill active management basher. Actually, I’d like to think of my idea as subtler: I believe in the existence of exceptional talents but I don’t believe one can find them easily (that’s why they’re exceptional). Nor are they likely to show up on the shelves of financial supermarkets. Hence, it makes sense that while you scavenge the world for that elusive deity, you park your funds in something less exhilarating but likely more lucrative.

Akademia is – or more properly will be when fully operative – a non-profit outfit: no extra money for anything except operating expenses. (Lest you think I’m turning “Bernie” on you, be reassured nothing could be further from the truth.) Their target clients will be European foundations. Benoit describes Akademia’s approach as simply doing the right thing by offering unbiased professional advice on how to run portfolios. The idea is to pool professional resources and offer them to endowments which otherwise could not access the same level of expertise and consequently would be relegated to accept inferior results. Akademia’s very organizational form (a European Cooperative Society) does the magic on the costs side since clients become shareholders of the firm and the board sets compensation for all staff. Call it a Vanguard for foundations if you want.

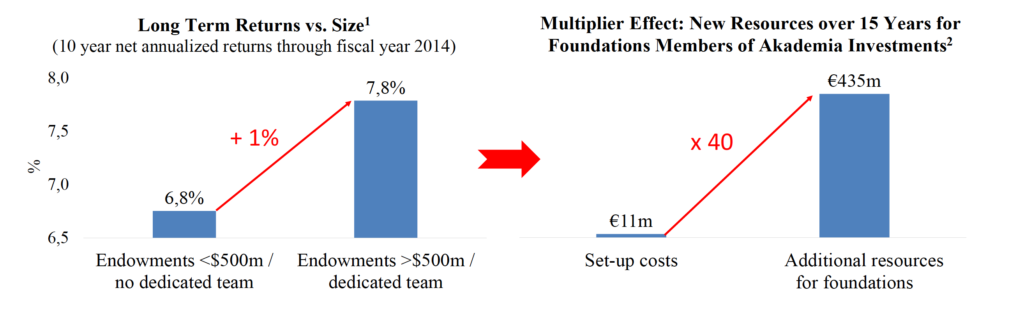

So Akademia is not your typical high fees, low returns, get rich story everyone likes to talks about. By bringing the best of institutional money management practices to its clients at a reasonable cost it enables them to capture higher returns and consequently generate more resources to distribute:

Akademia is in a position to produce one of those rare combinations where everyone involved comes out a winner: the foundations, their beneficiaries who will ultimately get more benefits over time, and the professionals who work for them.

I sent Benoit my resume’, but he thinks I’m too profit oriented for Akademia.

-Notes-

1. Source: 2014 Nacubo-Common Fund Study of [US] Endowments.

2. Assuming 1% extra returns over 4.5% annual returns with a 4% spending rate; and assuming Akademia Investments manages €5bn 15 years after reaching critical mass.

-Picture Sources-

1. Rene Magritte, “The Lovers”, 1928; http://www.hungertv.com/feature/heart-art/

2. Akademia Investments.