Of Death and Taxes (and Cockroaches)

Things We Control and Things We Don’t: Thoughts on Taxation.

Many clichés and sayings on how we die or what will kill us are mildly comforting. Other heroic demonstrations of defiance (like the skateboarder gliding through a crowded NYC subway platform or the woman cyclist crossing at full speed on a red light in front of your car) are pure idiocy. Ultimately we can’t avoid dying and so we don’t control death.

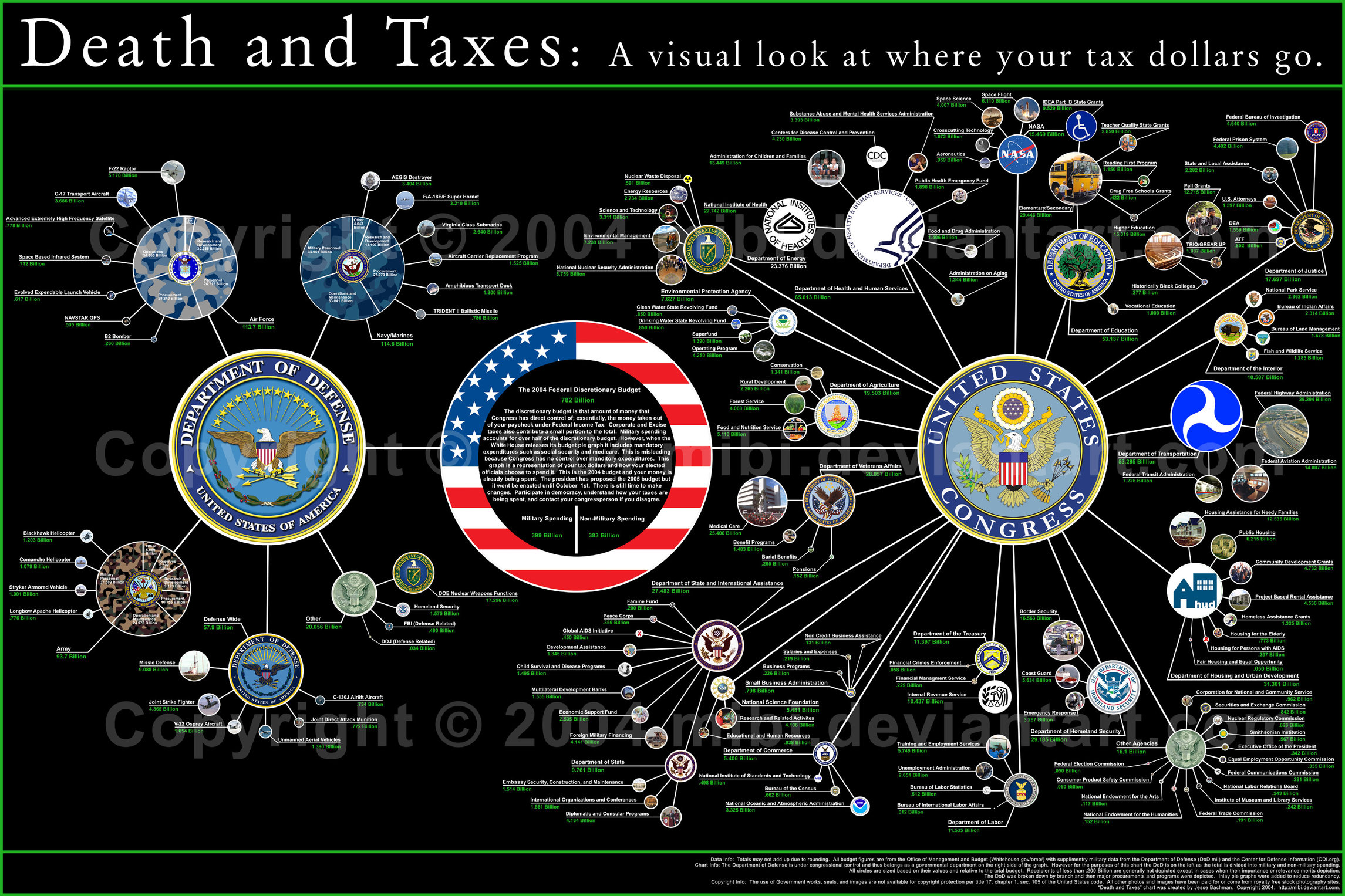

Taxes can be controlled. In theory they are a blessing in disguise since they are for the benefit of all residents of a nation and are levied to fund projects and activities that otherwise would be impossible to manage at a disaggregated level (there are a few exceptions in small countries with relatively homogeneous cultures). Infrastructure, education, defense activities (I don’t like them, but until we are out of our animal stage we need something), medical and other health support systems, financial aid for the needy or impaired, and training come to mind as a partial list.

We need taxes, at least if you plan to live in a country in a civilized manner. However, most of taxation currently suffers from a host of structural, political and economic problems.

Taxes are not a form of income redistribution, a feature overwhelmingly favored in today’s political debate, though income certainly plays a role in the amounts raised and determines who pays more of them. Furthermore, funds raised with taxes implicitly need an infrastructure of their own to be managed and spent sensibly; we call this infrastructure government and like all bureaucracies run by politicians it tends to be a very inefficient means of redistributing anything.

On a practical level, many studies have stated that the most efficient and economically sensible tax system would have a single flat tax on income and no deductions. Certain obvious considerations need to be addressed (such as the minimum income required to pay any taxes) to insure an equitable sharing of the burden. However, it’s easy to grow confused when you think about the second round consequences and beyond of implementing such a flat tax: all those tax specialists, professional analysts and politicians who have made the management of complex tax systems their business would be out of a job in a blink. While the long term advantages would be substantial, the initial impact would be negative.

Why don’t we talk more openly and rationally about all this? It’s a charged subject with extreme opinions at both ends of the spectrum, full of ideological content, and with bad information pushed by politicians trumping (no pun intended) their views to get voters. In other words, the usual stuff; up to all of us to make it different.

(Cockroaches: we don’t control them. Kafka tried and New York City is still home to unwanted billions despite efforts to annihilate them. Personally, I feel for these creatures since no one – animalists, vegans, religious sects, bankers – vouches for them. For more info on this family of insects, see this article [similarity with the title of this post is purely coincidental]).

-Picture Sources-

1. http://mibi.deviantart.com/art/Death-and-Taxes-9410862