To Earn a Return

This is an abbreviated version of a note I sent to my clients a few months ago. When speaking about “earning a return” on an investment, there is considerable confusion as to what return consists of, and how it can be obtained. Clarifying these points is relevant for it affects how one manages wealth.

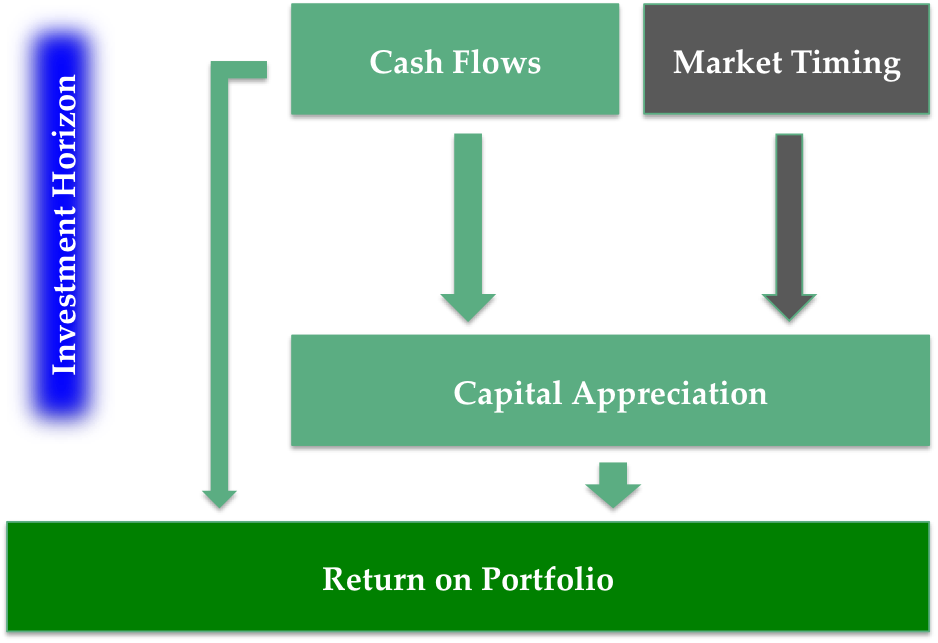

Return on an investment is the sum of the cash flows and the capital appreciation (positive or negative) it generates over a period of time.

Cash flows are generated by the underlying asset’s economic activity, and can materialize directly (coupon, dividend payments) or indirectly (retention of earnings). Whether cash flows are distributed to the investors or not, what matters is that they exist, because they constitute the principal reason to invest and ultimately become the drivers of market prices. Also, cash flows tend to be more predictable, though this predictability varies with the form of the investment.

Capital appreciation is principally composed of the growth of the cash flows, their valuation, and the change in value of the producing assets. It can theoretically also be achieved via frequent purchases and sales of investments (active trading, or market timing), basing one’s decisions on previous market price movements (technical analysis), new information, or other forms of analytical gymnastics.

The investment horizon determines both the exact numerical value of the return as well as its relevance or sustainability. In general, the longer the investment horizon the more “stable” the return and the greater the links with fundamental economic and business conditions.

Schematically, all of the above looks like this:

Market participants often ignore the importance of the time element. The elapse of time in investing can be pretty boring or at least unexciting, whereas there is a sense of “doing something” or “action” in buying and selling. Short-term focus is often a recipe for much money down the drain, because we know that prices are random in the short-term (below 2-3 years), but subject to a degree of predictability over longer periods.

In earning a return the important aspects are the interplay between cash flows, capital appreciation and investment horizon. While every portfolio situation or composition is different, four general observations are in order:

1. Gaining exposure to either capital appreciation or cash flows – by themselves or in combination – should be a function of the investment horizon.

2. For capital appreciation, a long investment horizon is advisable and is best attained with equity-based vehicles. It grows from the fundamental evolution of economic and political events.

3. For distributed cash flows over a more varied selection of investment horizons, fixed income securities are the preferred vehicles but equities also can play a role in portfolios with longer investment horizons (especially for inflation protection purposes).

4. Market-timing activities may occasionally yield positive returns, but there is ample evidence that this does not tend to work in a consistent and replicable manner especially when trading costs are included. As such it is not a reliable element in producing returns.

Photo source: www.yourarticlelibrary.com.