On Amazon.com and Competition

How Manchester Explorer’s Professionals See the Issue: Excerpts from Their Most Recent Letter to Investors.

“Treat all economic questions from the viewpoint of the consumer, for the interests of the consumer are the interests of the human race.” Frederic Bastiat

When one seeks to identify the truly awful things that have come out of Washington DC, they are, often as not, policies on which the right and the left agree. This is how you get sustained behavior. Alas, right now, a sort of awful agreement seems to be emerging around anti-trust and Amazon.com appears to be dead center of the gunsights. On its face, this seems odd as is the precipitation of so much concern by the proposed acquisition of Whole Foods.

To claim that acquiring Whole Foods somehow represents a monopolistic threat seems fanciful. They were in a 3-way tie for 9th place in market share for 2016 with a whopping 1.7% share of the grocery market. Walmart had 17.3%, 10X more. Kroger had 8.9%. Describing Whole foods as somehow massively altering the grocery landscape and creating monopoly/oligopoly pressure is just ridiculous. It smacks of politics and special interests, not economic sense. We suspect this pressure to do something about Amazon is coming from both the left and the right for different reasons, but suddenly, everyone wants a piece.

The left dislikes Amazon because it harms unions and because “it has too much market power” (an ironic criticism from folks that like to concentrate such power in government). It harms workers and it harms producers of books and toys and whatever else Bezos decides to sell. This is, of course, nonsense. Yes, a toy seller might get a lower price on amazon than in a retail store. But they also save on marketing costs, shipping costs, fulfillment costs, and 20 other things. If they made more money selling in physical retail, they would be doing it. They aren’t. The left also leaves a key issue out of their thinking: what about the consumer? Amazon is amazing. Great prices, incredible selection, near flawless delivery, and easy returns with fantastic customer service.

The point of anti-trust is to protect consumers. If Amazon is consumer harm, then please sign us up for a great deal more. The benefits accruing to the consumer are massive. In 2016, Amazon threw off $16.4bn in cash flow from operations. They plowed $6.7bn back into capital expenditure leaving $9.7bn. That’s a tidy sum to be sure, but it’s 7% of revenues. That’s a good figure for a retailer (though it is also driven considerably higher by Amazon web services) but hardly egregious monopoly rents. But let us consider the consumer surplus: the average order size on Amazon is a bit under $200. Let’s call it $200. $138bn in revs divided by $200 is $690 million orders. Let’s say each order saves 30 mins of shopping time (very conservative). 345 million hours saved. Average US wage is $24.57/hr. $8.48 billion saved in time alone. If prices were, say 10% lower, that tacks on another $13.6bn. And if we then benefit yet further from greater selection of products (especially in rural areas) the benefit to consumers rises further still. Sure, Amazon is winning, but consumers are taking the lion’s share.

Generally, one would expect the right to oppose the left here and act in a more business friendly fashion. Instead, led by the twitterer-in-chief, they seem to be lining up against Amazon. We suspect there are two reasons for this. First, Jeff Bezos is not “one of us” from their standpoint. He bought the Washington Post (likely a terrible mistake when the history of Amazon is written) and has not only made it into a viable organization, but has also taken its slant far, far to the left. In the age of “us vs. them, red team vs blue team” politics, this makes you the enemy. These flames are being fanned by traditional donors like supermarket chain owners, retailers, and manufacturers all of whom want less competition. Again, the needs of the consumer are sent begging. The only silver lining here is that perhaps the spinning of Bastiat in his grave can be harnessed as a source of renewable energy.

The whole antitrust argument is a trope. Barring the intervention of the state to grant some form of monopoly or oligopoly, it just never happens. Recall the furor over Microsoft in the 90’s for (gasp) bundling a browser and how such practices would destroy the PC and internet space. Such behavior is now standard practice. The space is one of the most vibrant and competitive in all of commerce. Microsoft got blown out on mobile platforms and runs a very distant third. This happens over and over. Consolidation is seen as evil and predatory. This is 180 degrees wrong. Mostly, it’s defensive and desperate. We looked at a number of cases and the evidence is VERY clear.

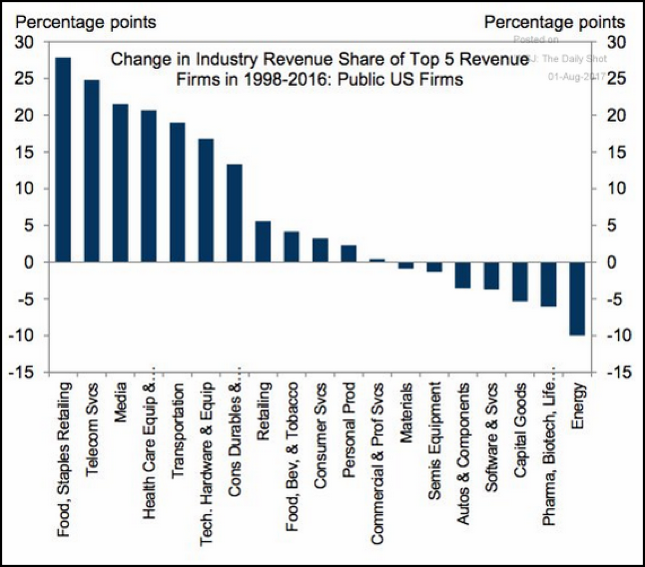

This chart shows changes in market share concentration by industry group from 1998 through 2016. Some of this looks jarring and worrying if you do not know what you are looking at. The top 5 food retailers picked up 28 points of market share. That’s massive. They now hold over 40% share. Amazingly, the share leader, Walmart, who holds 17.3% of the market (nearly twice the closest competitor) was barely even in the grocery business in 1998. This smacks of oligopoly and predation. Surely, such concentration of share must result in market power that will be wielded by greedy grocers to the detriment of consumers. Nope. Not even close. In fact, it is the greedy, mercurial, and self-interested consumer that is winning out. The grocers are losing. We ran an industry analysis of the top 5 groups that consolidated share and looked at their margins. Margins are down across this group. The power to extract monopoly profits should drive margins up. No one seems to have this power. The only significant gains were in trucking, and this has a HUGE asterisk next to it as using Q2 2008 as a start period is pretty slanted. That was the absolute peak of oil prices. They are down over $100 a barrel since then. Normalized for costs, margins in trucking are way down. If we adjust for that one seemingly reasonable exogenous factor, not a single one of the top 5 consolidated industries saw a rise in operating margin.

Grocery was especially hard hit (further making concerns over Whole Foods look disingenuous). Net margins dropped from an already razor thin 1.56% to 0.93%. That’s a 40% drop in net margin, and that’s only over 10 years (as far back as our dataset went). Over 30 it would be far worse.

Consolidation is not driving rent seeking and monopoly profits. It’s occurring as a result of relentless pressure from consumers to offer more for less. Firms are not getting big to prey on customers, share is concentrating because consumers have become so aggressive and have so many choices that only the very best can survive them. The flip side is the industries showing the most deconsolidation are energy and pharma, two of the most profitable industries extant in recent times. Energy is highly cyclical. Pharma gets monopoly grants from the government. But, high profits in both have clearly attracted entrants. Natural gas boomed, then price collapsed. Ditto oil. In every case, high profits attracted huge numbers of entrants and drove deconsolidation. This then ultimately drives profits back down (save in pharma where monopoly status is granted by law).

Thus, as ever seems to be the case, the current furor over antitrust has it all wrong. The would-be regulators have their causality inverted. It is not predatory firms consolidating to be anti-competitive and reap monopoly rents. It is predatory consumers forcing all but the strongest out of business. Blocking consolidation in such a case harms everyone. It keeps prices high for consumers. It is, as so many government programs tend to be, exactly what it purports to stop. Antitrust is what creates outsized profits and harms consumers. The case that it helps is non-extant. The case that it prevents the best from providing more efficient service is clear and obvious. The fact that both sides of the aisle are lined up in favor of it shows a deep misunderstanding of economics and how thoroughly captured government has become just as public choice theory would predict. (Hey, they don’t give out Nobel prizes in econ for nothing.) All these programs to protect the consumer wind up harming them. The best course is to leave it alone, stop interfering, and let the market serve the consumer.

-Further Readings-

My Current Reads – a list of the last 30 items (books, articles or blog posts) I found interesting: right column on HOME page, or under LIBRARY > MY CURRENT READS.

Research – economics and finance research papers: under LIBRARY > RESEARCH.

-Photo Sources-

Cover: http://everything-pr.com/amazon-creative-competition/13586/